As youíre starting up your

business, you will need to open a business checking account because

the check will be in the business name - not in your own personal

name.

To open a

business checking account, banks will require a business license or

a DBA certificate.

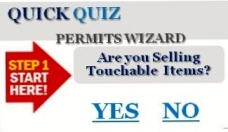

Don't know Where To Start?

Click Here

to

Take a Short Quiz

to see how to get your business license or if you really need a

license or any other document to start your business.

General Information About

Business Licenses:

Licenses are issued by the state, city or county where your business will be

located. The application for the

business license will

have instructions on how to apply and it is online. Some

governments may require that you present the application in person

but it is rear. You will have to pay your annual business tax

in advance and payment requires a check with the application, some

will bill you for payment. The type of payment is usually by check

otherwise, alternative methods will be in

the instructions.

In most cases this would not be an issue, but some local

governments my require you to complete

the application in blue ink, or typing the application, or even sending

two copies.

Fees

Most small business owners starting a business want to know how much is this going

to cost. Within any one state, the

application fee is usually between $30 to

$135, and the license is valid for one year. Business

licenses are not transferable -- any change of address, ownership,

type of business, or other information may invalidate the business

license, but you will be given credit from some local governments if

your new address is within the same locality.

The Application

Most applications are one to two pages

and will probably take ten to 30 minutes to complete. If you

are filing other documents, the online application is for all

documents so you don't need to waste time filling out many

applications. The applications ask for basic information

about your business. The first section will be administrative info:

name, address, contact information, type of organization, and other

information. Type of organization

or legal business structure, means Sole

Proprietorship, Partnership, Corporation, Non-Profit or Husband and

Wife. After

this basic business information, the questions to relate to your particular

business locality. Here are some examples:

- Do you have a State Contractorís License for this business?

- Number of employees?

- What will be stored or dispensed at this location:

food/drink; alcoholic beverages; firearms/gunpowder?

- Will you be providing: live music; dancing; pool; card

tables?

- How is your property zoned?

- Are you delinquent in any taxes?

How to Get Your Business License

Application

This is the Information Age. Many governments

now have the application available online.

All you need to do is fill out the form and

submit it. You can call for

information about obtaining additional information.

What if you cannot fill the business application online? Here is

a link for business licenses.

After you submit the information you will obtain a

business license. Then you'll need a DBA fictitious business name. What is a

DBA

fictitious business name and do I need one? See the article titled,

Getting a DBA Fictitious Business Name.

There is information online about local governments. The

National Association of Counties (NACO) has U.S. counties listed on

their site, with interesting statistics and even better--the

countyís web site. To locate the business license, first check

to see if thereís a search function within the site. If thatís

available, use it! If there is no search function, you want to find

that section of the site with business license

information. There is business license information under

these various search terms:

- County Departments

- Departments and Agencies

- Tax Commissioner/Treasurer

- Departments and Agencies

![]()

![]()