How to File a DBA

Business Name or DBA (Doing Business As)

Do I need to have a DBA?

What are the benefits to filing a DBA?

How do I go about getting a DBA?

Getting a Business Checking Account Under Your Business Name

How Do I Trademark My Business Name?

Business Registration Information

What legal structure is best for your business

How to incorporate

How to get any special licenses that may be required

How to arrange for a federal ID and federal tax payments

How to get any state and local tax licenses required

How to decide whether to hire employees

How to ensure your business will meet environment regulations

How to be aware of hidden liabilities and make sure you are

adequately insured.

Business Regulation Information

Any small business owner who owns a business located in the County

must register the name of the business with the County Clerk. The

business registration is good for 5 years and is renewable 30 days

prior to expiration for a $10.00 fee.

Download the form from this website

In some states, the dba Certificate of Assumed Name, Co-Partnership

or Dissolution form all owners of the business must have their

signatures notarized before the form is mailed to the County Clerk’s

Office.

If you change the name of your business, you must file a new

certificate.

You must notify the Clerk's Office if there is a change of address

for the business.

Adding or deleting owners you must: Dissolve the business and file a

new certificate.

It is the responsibility of the person conducting business to check

with the State to make sure that the business name is not being used

as a Corporation, Limited Liability Company ("LLC"), Limited

Liability Partnership ("LLP"), or Non-Profit Organization.

Corporations, LLC’s, LLP’s, Limited Partnerships and Non-Profit

Organizations:

LLC's, Corporations and Non-Profit organizations do not file with

the Clerk's Office

In some states, LLP's can file with the county, but must also file

with the State. The County Clerk cannot give legal advice;

therefore, contact your legal representative for more information on

this.

To register a Corporation, LLC, LLP, Limited Partnership, or

Non-Profit Organization apply to: Corporations & Securities Bureau

Forms Available for Download

Business Registration Certificates Fees

DBA / Assumed Name - (includes 2 certified copies)

Co-Partnership - (includes 3 certified copies)

Notice of Dissolution - (one copy)

Certified Copies (each)

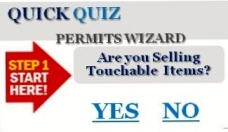

What Do I Do Next?

Small Business Development Center

In some regions Small Business Development Centers, are located at

Community College, and the College provides a free guide with all

the steps to starting a business! They also provide information and

counseling. Many of their services are low cost or free!

![]()

![]()