Obtain State Tax ID, Wholesale License, LLC, DBA Online.

Texas LLC

|

|

| Click

Here to Form an Connecticut LLC

Form an Connecticut LLC in Any State

Limited liability

companies, or Connecticut LLCs afford double

protection: the protection of a

corporation with tax benefits and simple

form of a partnership entity.

Click to Find Out What Business Document Filings You Need to Start Your Business.  As when you incorporate, when you form an

Connecticut LLC , you, the member / owner,

are not personally liable for its debts and

liabilities, but also have the benefit of

being taxed only once on your Connecticut

LLC or corporate profits.

Perhaps, an equally important feature is the

flexibility of an Connecticut LLC .

With an Connecticut LLC you are not

required to abide with corporate formalities

such as annual minutes .

Keep in mind though that you still need to

keep your bank accounts and paperwork

separate so you avoid being considered a

sole owner instead of a corporation.

As when you incorporate, when you form an

Connecticut LLC , you, the member / owner,

are not personally liable for its debts and

liabilities, but also have the benefit of

being taxed only once on your Connecticut

LLC or corporate profits.

Perhaps, an equally important feature is the

flexibility of an Connecticut LLC .

With an Connecticut LLC you are not

required to abide with corporate formalities

such as annual minutes .

Keep in mind though that you still need to

keep your bank accounts and paperwork

separate so you avoid being considered a

sole owner instead of a corporation.

There are advantages, disadvantages among different business structures. We can help you form an Connecticut LLC . Just follow the directions to answer questions online and submit the form, and we will do the rest. We will prepare all of the legal documents, and file the required Connecticut LLC formation documents with the appropriate government agency.

Click Here to Form an Connecticut LLC

lick Here to Form an Connecticut LLC or Form an Connecticut LLC |

|

Did not find your answer?

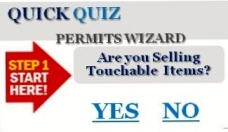

If not, you can take a 2 minute quick quiz to find out!

Did not find your answer? Just ASK ( CHAT ) WITH us!

Service Groups

Business formation occurs when you choose a business structure and file a certificate for it. For example, if you file an LLC, you structure is an LLC for tax purposes. If you file a DBA as a sole proprietor, you will be a sole owner proprietor.

After forming your business with an LLC, corporation or DBA certificate, we register your business for tax reasons such as sales tax ( seller's permit ) employment tax ( EIN, SEIN)

and business tax ( EIN, business license )

In addition, to forming your business, and registering for tax, you may need a professional license e.g., contractor's license, a health permit, tobacco or transient vendor's license.

You can select to have the filings expedited at check out or call us for same day service.

What Our Clients Say About Us

We ask some of our clients what they think about the experience working with us. Here is what they think