Obtain State Tax ID, Wholesale License, LLC, DBA Online.

Indiana LLC

|

|

| Click

Here to Form an Indiana LLC

Form an Indiana LLC in Any State

Limited liability

companies, or Indiana LLCs afford double

protection: the protection of a

corporation with tax benefits and simple

form of a partnership entity.

Click to Find Out What Business Document Filings You Need to Start Your Business.  As when you incorporate, when you form an

Indiana LLC , you, the member / owner,

are not personally liable for its debts and

liabilities, but also have the benefit of

being taxed only once on your Indiana LLC

or corporate profits. Perhaps, an

equally important feature is the flexibility

of an Indiana LLC . With an

Indiana LLC you are not required to

abide with corporate formalities such as

annual minutes . Keep in

mind though that you still need to keep your

bank accounts and paperwork separate so you

avoid being considered a sole owner instead

of a corporation.

As when you incorporate, when you form an

Indiana LLC , you, the member / owner,

are not personally liable for its debts and

liabilities, but also have the benefit of

being taxed only once on your Indiana LLC

or corporate profits. Perhaps, an

equally important feature is the flexibility

of an Indiana LLC . With an

Indiana LLC you are not required to

abide with corporate formalities such as

annual minutes . Keep in

mind though that you still need to keep your

bank accounts and paperwork separate so you

avoid being considered a sole owner instead

of a corporation.

There are advantages, disadvantages among different business structures. We can help you form an Indiana LLC . Just follow the directions to answer questions online and submit the form, and we will do the rest. We will prepare all of the legal documents, and file the required Indiana LLC formation documents with the appropriate government agency.

Click Here to Form an Indiana LLC

|

|

Did not find your answer?

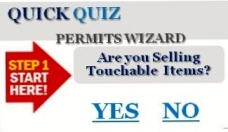

If not, you can take a 2 minute quick quiz to find out!

Did not find your answer? Just ASK ( CHAT ) WITH us!

Service Groups

Business formation occurs when you choose a business structure and file a certificate for it. For example, if you file an LLC, you structure is an LLC for tax purposes. If you file a DBA as a sole proprietor, you will be a sole owner proprietor.

After forming your business with an LLC, corporation or DBA certificate, we register your business for tax reasons such as sales tax ( seller's permit ) employment tax ( EIN, SEIN)

and business tax ( EIN, business license )

In addition, to forming your business, and registering for tax, you may need a professional license e.g., contractor's license, a health permit, tobacco or transient vendor's license.

You can select to have the filings expedited at check out or call us for same day service.

What Our Clients Say About Us

We ask some of our clients what they think about the experience working with us. Here is what they think