Obtain State Tax ID, Wholesale License, LLC, DBA Online.

North Carolina Wholesale License |

|

How do I get a NorthCarolina a Wholesale License? A wholesale License is a sales tax ID number. You need it to buy or sell wholesale. It is also called a Seller's Permit, Resale ID, Reseller License or State ID. Example:Edward starts a business from home selling stuff on the internet. He wants to buy stuff wholesale and then post them online and sell them retail. To buy wholesale, Edward will need to obtain a seller's permit. The seller's permit includes a resale certificate that will sign and fax to the wholesaler so Edward can prove to the wholesaler that he has a seller's permit ID number that enables him to buy wholesale. For instance, if Edward buys 500 widgets for $1 each, he would have to pay $500 plus sales tax but since he buys wholesale he does not have to pay the sales tax. When Edward sells the widgets online he will have to charge about 8% tax in most states and collect it to pay the government. You can obtain it here online or take this short quiz Click to Find Out if you need it or other permits to start your business. What Is a NC Wholesale LicenseA NC Wholesale License is a NC state sales tax ID. Wholesalers need it to sell wholesale to resellers and resellers, retailers, need it to buy wholesale and also need it to sell retail and collect sales taxes. You Can Obtain a NC Wholesale License Here On this Site.

So, It is a Tax ID. Do I Need Other Tax IDs?Every new business is required to have its own North Carolina Wholesale

License depending on the particular facts of your business. There are

several different ones. A federal North Carolina Wholesale License is

a business tax id and also a federal employer number.

Click to Find

Out What Business Document Filings You Need to Start Your Business.

What are the 2 NC Tax IDs?A state tax id can be a state tax id employer number or a wholesale North Carolina Wholesale License. Then there is a business license number that you get and it is essentially another North Carolina Wholesale License also called a secretary of state ID number. So, How Many Tax IDs are There?Things can be complicated but use our service and we will make sure you get what you need. For example, if the IRS issues you a number, you may have to get a North Carolina Wholesale License from each state in which you have a business address. Should I Hire a Lawyer?There are many federal and state government sites that might help you get the id, but they are not exactly easy to navigate or read. You can ask your lawyer, bookkeeper or accountant to find out what you need, but they may charge you for their time. Can You Obtain the Wholesale License For Me?We can get you the North Carolina Wholesale License quickly. If you have problems, call us. We may be able to get you the number right away. The average wait to reach a customer representative is one to two minutes. It helps to have already submitted the form, because the agent will ask you many of the same questions. If you have a problem with a North Carolina Wholesale License , first call us. Explain the problem to the agent will help you resolve quickly. Normally, it may have been a problem with the email that is why you may have not receive your North Carolina Wholesale License .

Here is a List of NC Tax IDs and Taxes

Where Can Obtain My NC Tax IDs?Obtain your North Carolina Wholesale License s from our Web site. You can fill out your application form online and get a number assigned quickly. Whether you are looking for a federal North Carolina Wholesale License or simply you are wondering how to get a North Carolina Wholesale License, we can help you get it here. How Much Do You Charge to Help Me Get a NC Wholesale License? About $39 for a North Carolina Wholesale License for a business or a business North Carolina Wholesale License. Our service is not free when you use our service to obtain it. There is a fee for our services. So if you apply for a North Carolina Wholesale License with us, whether it is a state North Carolina Wholesale License or you are applying for a federal North Carolina Wholesale License , click here to select state first. What is the Process? |

|

Did not find your answer?

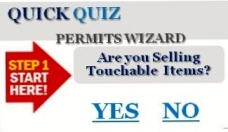

If not, you can take a 2 minute quick quiz to find out!

Did not find your answer? Just ASK ( CHAT ) WITH us!

Service Groups

Business formation occurs when you choose a business structure and file a certificate for it. For example, if you file an LLC, you structure is an LLC for tax purposes. If you file a DBA as a sole proprietor, you will be a sole owner proprietor.

After forming your business with an LLC, corporation or DBA certificate, we register your business for tax reasons such as sales tax ( seller's permit ) employment tax ( EIN, SEIN)

and business tax ( EIN, business license )

In addition, to forming your business, and registering for tax, you may need a professional license e.g., contractor's license, a health permit, tobacco or transient vendor's license.

You can select to have the filings expedited at check out or call us for same day service.

What Our Clients Say About Us

We ask some of our clients what they think about the experience working with us. Here is what they think